The UV LED market has broad prospects! The global market size is estimated to increase by 27% annually from 2018 to 2023.read count [222] release time:2020-03-12 20:15:00

The "2019 Deep UV LED Application Market Report" released by TrendForce's LED Research Center (LEDinside) shows that the global UV LED market size reached US$299 million in 2018 and is expected to reach US$991 million by 2023, with a compound growth rate of 27% from 2018 to 2023.

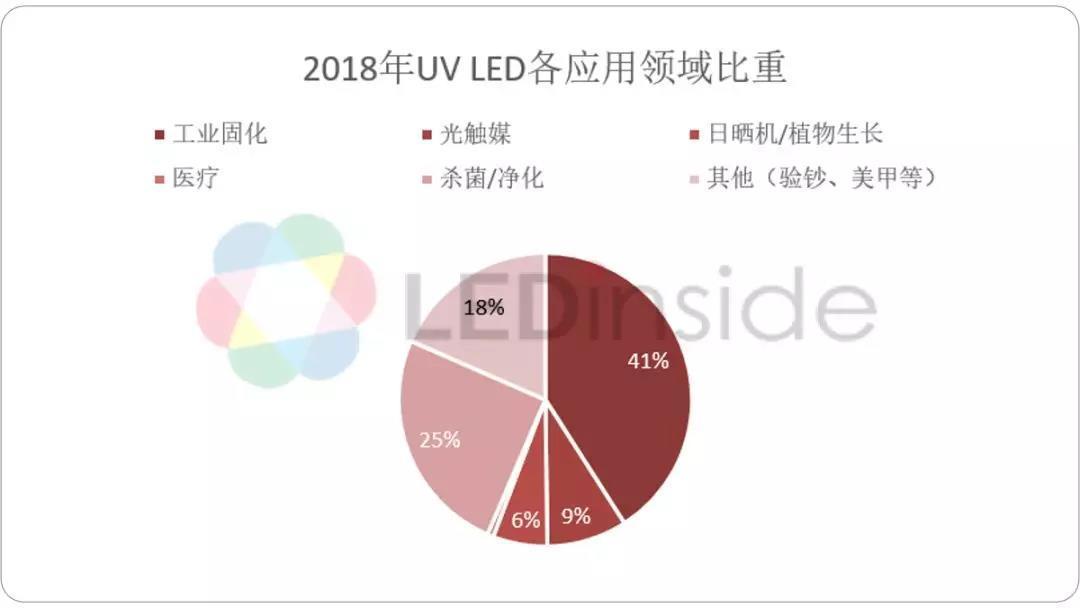

Data source: LEDinside

As one of the LED segmented application markets, UV LED can be said to be in its infancy, and the market has not yet been widely used. It is precisely because of this that it is expected to have high growth in the future. UV LED is currently mainly used in industrial curing, photocatalysts, banknote inspection, manicure, tanning machines, plant growth, medical treatment, sterilization, purification and other fields. Each application field corresponds to different wavelengths, and products include UV-A, UV-B and UV-C.

At present, industrial solidification has the greatest demand, and sterilization and purification have the highest growth potential in the future.

Data source: LEDinside

Industrial curing is currently the largest application field of UV LED, accounting for 41% of the total UV LED market size in 2018. Products in the industrial curing field are mainly UV-A LEDs.

The technical threshold for UV-A products is relatively low, so market price competition is fierce. However, it is expected that regulations prohibiting the use of mercury lamps (Minamata Convention) will be fermented in 2020. The active introduction of UV LED products by industrial curing equipment manufacturers in Europe, the United States and Japan will drive demand for machine modifications and replacement markets.

It is estimated that the market penetration rate of UV LED industrial curing modules will also reach 30-40% in 2020, driving the growth of the overall UV-A LED market. In the next five years, the market size of the industrial curing field will still maintain rapid growth, second only to the sterilization and purification market.

The sterilization/purification market is the market with the fastest development and the most potential in the future. It is currently mainly used in the sterilization and purification market of drinking water. In 2018, it accounted for 25% of the total UV LED market size. The products in the sterilization/purification market are mainly UV-C.

The technical threshold for UV-C products is relatively high, especially in the field of epitaxial chips. The main technology is in the hands of Japanese and Korean manufacturers. Although domestic manufacturers continue to launch UV-C chips, there is still a gap with international manufacturers, and the product yield rate is low. Therefore, the price of UV-C products is still high, resulting in the proportion of UV LED sterilization/purification modules used in end products still at a low level.

However, with the entry into force of the Minamata Convention and the continuous decline in product prices, in the future, in the field of home appliances, UV implantation LED module The proportion of products will increase rapidly. LEDinside also observed that well-known brands including Midea and Angel are also actively introducing UV LED sterilization/purification modules into end products. In the next five years, the sterilization and purification market will be the main driving force for the growth of the UV LED market, and the market size will surpass the industrial curing market.

In other fields, photocatalysts are mainly used for air purification, and products using UV-A will maintain stable growth in the future market. The plant growth and medical fields mainly use UV-B products. The supply chain in this field is relatively closed, and many end customers have clear customized needs. The market size will remain stable in the future. Markets such as banknote detectors and nail art mainly use UV-A products. They are now relatively mature and will maintain stable growth in the future.

Domestic manufacturers are making plans one after another, and the gap with international counterparts is constantly narrowing.

At present, the UV LED market size is relatively illumination , backlight, display and other traditional applications are small, but they have high growth potential in the future, and the market competition in traditional application fields is fierce. Many manufacturers have deployed in the UV LED market to find new profit growth points, including Nationstar Optoelectronics, Hongli Zhihui, Jingneng Optoelectronics and Tiandian Optoelectronics.

The threshold for UV LED technology is relatively high, especially in the UV-C field. Both epitaxial technology and packaging technology have relatively high requirements. Therefore, currently, the products with high requirements on the market are mainly produced by Japanese and Korean manufacturers.

However, since 2019, more and more capital has entered the UV industry. In the chip field, in addition to those who have been deeply exploring this market Sanan Optoelectronics , Jingneng Optoelectronics and Qingdao Jason, projects such as Zhongke Lu'an and Hubei Deep Purple have also appeared on the market. In the field of packaging, domestic manufacturers represented by Nationstar Optoelectronics have continuously enriched their product lines, ranging from near-ultraviolet UV-A to deep ultraviolet UV-C, and product performance has also been rapidly improved.

Nationstar Optoelectronics has launched new UV products one after another since 2016, and has now completed a comprehensive layout of UV-A/B/C products, including mosquito trap/manicure series, industrial curing series, and sterilization, phototherapy, and purification series. The products are widely used in sterilization, phototherapy, curing, photocatalyst, plant growth, mosquito trapping, manicure, and other fields. Market feedback is good, and we have established cooperative relationships with many well-known manufacturers.

In terms of performance, Nationstar Optoelectronics has increased research and development efforts in various aspects such as materials, equipment, and packaging processes, and its product performance has been continuously improved. its launch UV LED The product has the advantages of lower thermal resistance, higher light output and better air tightness. For example, silicone 3535 series UV-A products use nano-encapsulation technology, which greatly improves the thermal resistance of the device. The thermal resistance is more than 40% lower than conventional packaging products, and the device has better heat dissipation. ; The silicone 3535-60 degree product uses a uniquely designed primary optical lens to increase the light output of the device, and the optical power is increased by 6.6% compared to conventional 60 degree package products.

At present, the main reason why the UV market has not taken off on a large scale is that the cost is too high. The products of international manufacturers have superior performance but are expensive. With the entry of domestic capital and the continuous improvement of technology, the price of UV products will continue to decline in the next few years. By then, the application scope will gradually open up, and the market demand will rise rapidly.